If you have a choice between where to get payday money – using a cash advance application or a regular payday loan, then this article will help you. Here you can find the answer and choose the right type of loan for you.

If you find yourself short on funds, you may need to borrow money fast to keep up with your obligations or cover an unexpected expenditure. When this occurs, you can think about getting a credit card cash advance or a payday loan.

Credit card cash advances and payday loans have one thing in common: they both allow you to get money rapidly.

However, before choosing any choice, it’s important to grasp the fundamental distinctions between the two.

What Exactly Is a Payday Loan?

Payday loans are instantaneous cash advances protected by the borrower’s personal check or online access to their bank account.

After submitting a personal check for the amount borrowed plus the financing cost, borrowers get cash.

In some circumstances, borrowers may be forced to provide electronic access to their bank accounts in order to accept and repay payday loans.

When loans and financing charges must be paid in one lump amount, lenders keep the checks until the borrower’s next paycheck.

Borrowers may pay a loan with cash, allow the check to be deposited at the bank, or just pay the financing fee to roll the loan over for another pay period.

This type of loan is for those who have unplanned expenses or simply run out of money. The good news for them is that they can google I need 300 dollars now online direct lender only deposit today get instant results, take a few minutes to read the terms and conditions, and get paid instantly. To learn more about payday loans, you may read online articles from sites like https://www.theexeterdaily.co.uk/news/blogs/are-payday-loans-worth-it.

How Do PayDay Loans Work?

Payday loans provide a quick method to get a modest amount of cash without a credit check, but they are costly to borrow.

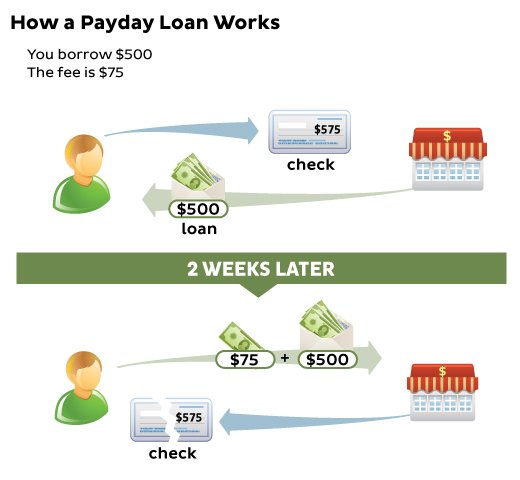

This is how they work: A payday lender makes a modest loan that is returned with the borrower’s next paycheck for a cost ranging from $10 to $30 for every $100 borrowed. The borrower submits a post-dated check or authorizes the lender to take the loan amount, plus fees, from their bank account on their next paycheck.

For example, you want to borrow $500 for your paycheck. Typically, in payday loans, you must write the lender a check for $575 (additional fees may vary depending on the lender) and agree on a time frame for which you must repay the money.

While some borrowers may be able to pay off their payday loans in full within a few weeks, many must “roll over” their debts into a new loan, paying a new financing charge and increasing the cost of borrowing.

What Exactly Is a Cash Advance App?

Cash advance applications let you deposit money you’ve previously earned into your bank account prior to payday. These apps are often free or require a small fee, but they do not charge interest on the loans.

Even with the upfront costs, they are a more affordable option than payday loans or even credit cards.

Financial advance applications may help those who are dealing with cash flow by providing a tool to break the paycheck-to-paycheck cycle.

Next, you pay the $575 cash back to the lender, who gives you back the check. And so you pay $75 for getting $500 before payday.

How Do Cash Advance Apps Work?

Users of direct-to-consumer payroll applications may get a cash advance, usually against a future paycheck or direct deposit.

The money advanced is immediately removed in one lump payment by the app when it is due, which may be when your paycheck is transferred into your bank account, depending on the app. Earnin, Brigit, and MoneyLion are a few examples of direct-to-consumer applications.

Some applications also provide “advantages” to subscribers and, on occasion, non-members. These advances may be offered as a sort of automated overdraft protection or on an as-needed basis if certain criteria are satisfied.

Apps may need a monthly subscription cost, a membership fee, or optional gratuities. A cash or salary advance app, like other payday loans, allows you to borrow money with no credit check.

Payday Loan vs. Cash Advance

Payday loans and cash advance services have more similarities than distinctions, according to consumers. Both businesses offer fast cash when you’re in a problem by allowing you to borrow money that you can back with your next paycheck.

The greatest difference is cost adding that payday loans are infamous for having high APRs.

However, the fees and voluntary contributions frequently imposed by earned-wage providers, referred to as “tips,” should not be overlooked.

Traditional payday loans have a long and contentious history in the United States.

Legislators have tightened and eased lending limitations throughout the years by establishing legislation that stipulates allowed loan term lengths and maximum financing costs.

However, app-based cash advance businesses are a relatively new notion. The services are also known as earned-wage, early-wage, or payroll advances, and are often supplied by fintech businesses rather than conventional payday lenders.

Earned-wage advance firms like Earnin and Dave, instead of collecting loan financing costs, ask consumers to tip on their “free” cash advance.

Earnin recommends tipping in cash amounts of up to $14 per advance, but Dave recommends tipping between 5% and 15% of the entire advance.

There are times when the cache progress of the program is extremely noticeable. For example, you may claim that it is less expensive and may not result in an overdraft charge. In addition, if you do not return it, the app will not send you to collections.

You must also refund the loan, as well as any costs you agreed to, on your next salary. App users may find themselves in a similar cycle to that of a traditional payday loan.

Cash Advance Apps and Payday Loans Should Be Used With Caution

Now that you understand the distinctions between cash advance apps and payday loans, it’s time to analyze the disadvantages of each. One disadvantage is that they are highly pricey.

Payday loans, in particular, are renowned for trapping consumers in an ongoing cycle of debt.

Because payday loans are so expensive, debtors sometimes have to take out additional loans to pay off what they owe.

Cash advance applications may sometimes be expensive. You must not only pay an upfront charge to get one, but you will also begin incurring interest on the amount advanced almost immediately.

Most individuals use cash advance applications and payday loans when they are in financial trouble, but they might end up in even more debt as a result. Only in a serious financial emergency should you use a cash advance app or a payday loan.

Which Is the Better Option: Payday Loan or Cash Advance App?

If you’ve determined that short-term financing is the way to go to meet your urgent financial needs, the decision between a cash advance and a payday loan will be influenced by a number of variables.

These criteria include whether payday loans are allowed in your state, the amount you want to borrow, and how quickly you can repay the money.

Also, you will need to take into account the interest rate, the speed of receipt, and availability. Choose wisely and always look for alternatives.