A certainty it might be, but death is hardly a cheery subject and one which none of us really wants to think about. Yet, by giving this difficult subject some thought now, it may be possible to head off even more grief and soul-searching – not to mention expense – when your time comes, hopefully many years from now.

The cost of dying

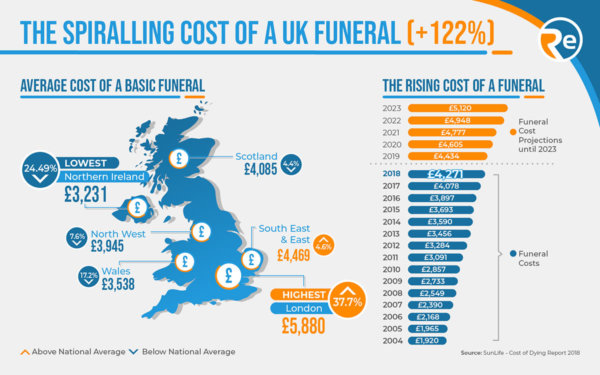

Depending on the source, the average cost of a funeral in the UK today is estimated to be between £3,800 and £4,000 – an all-time high, and an escalation in prices which has far outstripped the rate of inflation over the past decade. And that represents only the costs of the funeral director. When additional costs, such as floral tributes, memorial stones, extra limousines and a wake or reception are taken into account, the so-called “cost of dying” has reached a total of nearly £9,000

The fallout from such an escalation in funeral costs is widespread. It has meant, for example, that according to some surveys, as many as one in six families are struggling to pay for the funeral of a loved one. The average family is incurring debts of £1,700 in finding the money to pay for the funeral and as many as one in ten are having to sell belongings in order to raise the funds and repay debts.

This infographic from life insurance broker Reassured displays the spiralling cost of a UK funeral:

Planning ahead for your funeral

As uncomfortable as it may be to be thinking about your funeral and funeral costs now, there are very good reasons why it may well be worth the effort:

1) You are in a position to make the decisions about the type and nature of the funeral you want – and may save your family some difficult and agonising times if they had to make those decisions on your behalf.

2) By paying for your funeral in advance, you also save them the financial burden of meeting those costs – and the risk of driving them, like so many others, into debt as a result.

3) Paying for your funeral costs in advance, you get to pay at today’s prices rather than those which are likely to be considerably higher when the time comes – funeral costs have risen by some 70% in the past decade, noted Metro newspaper on the 13th of September 2017, and there is little sign of such runaway inflation abating any time soon.

4) Purchasing a prepaid funeral plan, you may achieve all of these benefits and rest easy in the knowledge that your funeral is not only going to be taken care of in the way you want it to be, but also that you have saved your family and loved ones the anguish of finding the money they might not have.

Prepaid funeral plans

The cost of a prepaid funeral plan may be met by a single payment but most providers also offer the opportunity of paying by instalments over 12 months, more than a year and even up to 15 years.

If the cost of a prepaid funeral plan is beyond your present means, you might want to consider an alternative way of saving for at least part of the inevitable costs by purchasing a typically economical over 50s life insurance policy – a whole of life policy which pays out a guaranteed cash lump sum when you die and which may be used by your designated beneficiaries to meet some or all of the costs of your funeral if they so wish.